An inspiring space for escape, adventure, discovery and quiet reflection

# Volume and value of tourism

The Peak District saw visitor volumes hit a record high in 2019, with 14.09 million visitor days recorded representing a growth in visitor days of 19% since 2009. Tourism expenditure also reached record levels, with £730 million generated from tourism in 2019. Representing a real term growth of 5.1% since 2018.

There is a delay in the availability of much of the data we rely on to assess tourism in the PDNP. STEAM data has a time lag of 6-12 months from the end of each calendar year. Large scale visitor surveys are expensive and face-to-face surveys are not practical during a pandemic. Smaller surveys can help identify new visitor profiles or behaviours at hotspots of high visitor pressure, but cannot replace a Park-wide survey.

Certainly it will be some time before we can truly quantify the effects Covid-19 has had on the visitor economy and the changes it has brought about in visitor profile and behaviour. Therefore, most of this report references known long term trends outside of the Covid-19 impact, unless otherwise stated.

# Volume of visits to the Peak District are increasing

The Peak District attracts 12.64 million visitor days per annum and 13.43 million to the wider influence area. From this point forward, all data will refer to the wider influence area unless stated. Using STEAM data only, this makes the Peak District the fifth most visited national park in England [1]. However, in reality, tourist numbers for the Peak District are much higher as leisure day visitors are not counted as part of the STEAM model.

Overall, this represents an increase of 19% of visitor days between 2009 and 2019 [2]. Comparable time series data for all national parks in England is not yet available for 2018 or 2019. Absolute tourist numbers have also increased (2009-2019) and, importantly for the tourism economy, there has been a growth in the proportion of overnight staying visitors to the area (9.6% growth between 2009-2019) [2:1].

STEAM: Volume and value of tourism in the PDNP 2009-2019

# Two out of five visits to the countryside involve a national park in England

A Visit England study [3] in 2014-2015 showed there were 3.81 million domestic overnight trips in England per year that involved visiting a national park. In addition, there were nearly 53 million day visits that involved visiting a national park, 4% of all tourism day visits in England and 19% of domestic day trips to countryside & villages, with associated spending of over £1.5 billion.

Unlike STEAM, the Visit England study used data from consumer surveys (demand side data). This led to the difference in overall volume figures produced. However, it provides a useful context of visit patterns of domestic tourism and visits to the countryside as a whole.

# People are spending more time outside in the natural environment than ever before

The pattern of growth in Peak District visitor volume is reflected in the Monitor Engagement Natural Environment survey, which shows more people are visiting the natural environment than ever before [4]. Between March 2018 to February 2019, around three in five adults living in England (65%) reported taking visits to the natural environment at least once a week. Half (52%) of visits were taken to natural places within a town or city, while 36% were taken to the countryside and 12% to a beach or other coastal location.

# Covid-19 visitor numbers: what data do we have?

We know from looking at vehicle counters around the county that the PDNP experienced a large decrease in visitor numbers around April and May (2020) at the beginning of the first lockdown. This is reinforced by the national People & Nature Survey [5]. During the pandemic, a smaller proportion of adults spent time outside in green spaces and the PDNP experienced reduced visitor numbers. For example, in April 2020, the proportion of adults in England that spent time in any natural environment at least once a week was only 41% compared with their reported average over 12 months of 73%.

Since lockdown restrictions were relaxed in England between May and August (2020), there has been an increase in adults in England spending time in green and natural spaces and National Parks in England. Crucially, in August 2020 alone, almost half the adult population (45%) said that they were spending more time outside than before Covid-19 [5:1].

What are the gaps in our research & data?

- Mobility (or other mobile application) data can give us a good indication of large volumes of recreational use way beyond traditional counters in the landscape. However, it remains expensive to procure the data, and is unlikely to available cut to the PDNP Boundary.

- We need to bring together a dashboard of information for key partners in the National Park showing long term and emerging trends of visitors.

Who collects mobility data and who publishes it?

Both public and private organisations collect mobility data. Big tech companies, such as Apple, Facebook and Google have all published data, as have many mapping companies such as TomTom and Citymapper, as well as public authorities like councils and research and academic institutions.

Google Mobility Data (opens new window) for Derbyshire shows a large decrease in retail & recreation during the pandemic (compared to the pre-pandemic baseline)

The data shows how visits to places such as corner shops and parks are changing in each geographic region. These reports show how visits and length of stay at different places change compared to a baseline.

Changes for each day are compared to a baseline value for that day of the week:

- The baseline is the median value for the corresponding day of the week during the five week period 3 Jan – 6 Feb 2020.

- The reports show trends over several weeks with the most recent data being from April 2021.

| Area | High Peak | Debyshire Dales | Derbyshire |

|---|---|---|---|

| Retail & Recreation | -55% | -50% | -46% |

| Supermarket & Pharmacy | 12% | 1% | 0% |

| Parks | 285% | -37% | 52% |

| Public Transport | -18% | -30% | -28% |

| Workplaces | -46% | -45% | -43% |

Strava Metro Data (opens new window) for Derbyshire shows a large increase in number of recreational trips in 2021

The Strava dataset is the largest collection of human-powered transport information in the world. Its like having thousands of trail counters set up across the National Park. It is the only way to truly understand the movement of people and their recreation distribution in an open landscape. Unfortunately, data is only available for Derbyshire County. We are currently working on extracting smaller sample areas of data for sites within the PDNP.

- In 2020, for the first time recorded on Strava in Derbyshire, locals accounted for more recreational activities than tourists in Derbyshire.

- January to April 2021 shows an increased number of trips and number of people engaging in recreation than any other year of data (2017-2021).

The Apple Mobility Data (opens new window) for Sheffield shows a massive decrease in people using public transport (similar to national trends)

Relative volume of directions requests per country/region, sub-region or city compared to a baseline volume on 13 January 2020.

Apple Maps Mobility Trends Change in routing requests since 13 January 2020 for the City of Sheffield (averaged by Month)

# Seasonal trends in the Peak District

Both tourist day visitors and staying visitors follow a distinct seasonal pattern peaking in the summer months from May to September. The peaks in August and September are likely due to the impact of large organised summer events and the school holidays.

Like many areas and destinations similar to the Peak District, tourist numbers (or volume) are highly seasonal. However, the geographical location of the Peak District means this area will always attract large volumes of people for short periods throughout the year. Such patterns of high visitation puts pressure on local services, communities and the environment especially in the high peak season through the summer.

STEAM: Volume of visits in visitor days per month, 2019

# Value of visits to the Peak District is showing growth

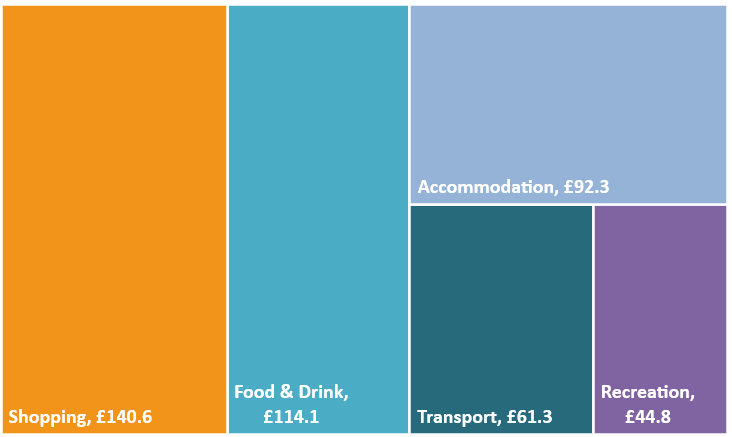

Long term trends (between 2009 and 2019) in the Peak District show the overall economic impact of tourism has increased by 48.8% in the Peak District and influence area and by 19.1% indexed to price inflation 2019 [2:2]. The total economic impact stands at an estimated £730 million, which is measured by two categories: direct (income derived from expenditure) and indirect (secondary expenditure) revenue. Both categories have increased by 10% over the last 3 years [2:3].

In terms of English national parks as a whole, the Peak District share by area accounted for 12% of the total economic impact in 2015 (£4,983 million per annum) [1:1].

STEAM Sectoral Distribution of Economic Impact; Tourist Expenditure (£Million 2009-2019 indexed 2019)

| SECTOR / YEAR | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Accommodation | 80.6 | 85.0 | 82.7 | 83.1 | 84.7 | 86.3 | 82.6 | 81.9 | 87.1 | 86.9 | 92.3 |

| Food & Drink | 99.7 | 97.7 | 99.3 | 96.6 | 96.1 | 98.8 | 99.8 | 100.3 | 107.1 | 108.8 | 114.1 |

| Recreation | 39.5 | 38.5 | 39.2 | 38.0 | 37.7 | 38.7 | 39.2 | 39.4 | 42.2 | 42.8 | 44.8 |

| Shopping | 123.8 | 119.8 | 122.4 | 118.8 | 117.7 | 120.8 | 122.7 | 123.6 | 132.8 | 134.7 | 140.6 |

| Transport | 54.1 | 52.9 | 53.8 | 52.1 | 51.8 | 53.2 | 53.8 | 54.1 | 57.7 | 58.6 | 61.3 |

| Direct Revenue | 397.7 | 393.9 | 397.3 | 388.6 | 388.1 | 397.8 | 398.1 | 399.2 | 426.8 | 431.7 | 453.1 |

| VAT | 59.7 | 68.9 | 79.5 | 77.7 | 77.6 | 79.6 | 79.6 | 79.8 | 85.4 | 86.3 | 90.6 |

| Direct Expenditure | 457.4 | 462.9 | 476.8 | 466.3 | 465.7 | 477.4 | 477.8 | 479.0 | 512.2 | 518.0 | 543.7 |

| Indirect Expenditure | 155.5 | 156.3 | 161.2 | 157.7 | 156.8 | 161.0 | 161.5 | 162.2 | 173.9 | 176.0 | 185.9 |

| TOTAL | 612.9 | 619.2 | 638.0 | 624.0 | 622.4 | 638.4 | 639.2 | 641.2 | 686.1 | 694.0 | 729.7 |

Economic activity associated with tourism also provides much needed income to facilities and services enjoyed by residents. Facilities that would be unsustainable without the additional income from tourism.

STEAM: Treemap £m Economic Impact per sector 2019.

# Visitor spend in the Peak District

STEAM shows staying visitors spend and contribute more to the economy per person overall than tourist day visitors. Of the total economic impact of tourism (£730 million), staying visitors contribute 52% compared with tourist day visitors 48%. The economic impact of a tourist day visitor (per person) is £38.90 compared with £74.95 for a staying visitor (per visitor day).

Given that the average length of stay of a staying visitor is 4.1 (measured in days), the total impact of a staying visitor is £304.24 (per person) and much higher than that of a tourist day visitor. Compared with the Visit England Survey 2014 [7], the Peak District performs around average with the Domestic Overnight Stay (Per Day) £62, International Overnight Stay (Per Day) £85 and Domestic Day Visitor (Per Day) £34 [1:2].

# Tourism supports over 10,000 jobs in the local economy

In 2019, employment supported by tourism was 10,382 jobs, representing a large proportion of the Peak District employment market. However, jobs in this industry can often be low skilled and seasonal.

Employment supported by tourism has increased by 13% between 2009 and 2019 [1:3].

# Tourism economy in England is on the rise

Since 2010, tourism has been the fastest growing sector in the UK in employment terms. Taking into account direct and indirect impacts (including aspects like the supply chain), estimates suggest the visitor economy is worth £106 billion in England with the sector supporting some 2.6 million jobs. Britain is forecast to have a tourism industry worth over £257 billion by 2025 [6].

Looking at direct impacts only, tourism still contributes £48 billion, supporting 1.4 million jobs. In 2011, there were 208,880 VAT registered businesses in England in tourism sectors, including accommodation, food and drink, transport, travel agencies, cultural activities and more [7].

In 2017, British residents spent £19.0 billion on 100.6 million overnight trips in England, adding up to a total of 299.4 million nights away from home. £50.9 billion was spent on 1.5 billion domestic tourism day trips. Overseas visitors to England spent £19.7 billion in 2016, making 33 million trips and staying for 246 million nights. 1.6 billion day trips were taken to English destinations in 2016, with spending totalling £53.5 billion [7:1].

# Growing & developing the visitor economy within Derbyshire

Data from the Business Register and Employment Survey (opens new window) (BRES) suggests employment in SIC codes in Derbyshire that are related to the visitor economy increased from 13,800 in 2015 to 18,605 in 2016 (the latest data). Using BRES data at a local level does come with some health checks (and cannot be replicated for the PDNP), but it has recorded a very healthy growth at 35%. Most of the growth has been driven by an increase of 1,500 jobs in the hotels sector (partly driven by refurbishments and new developments that year) and an increase of around 2,500 jobs in licensed/unlicensed restaurants [7:2].

The latest LEP figures from the Scarborough Tourism Economic Activity Monitor (STEAM) show that Derbyshire added £2.3 billion to the area’s economy, supporting over 30,000 jobs and attracting 42 million people to the area in 2018 – marking another year of significant growth and a remarkable 7.4% increase on the previous year [8].

# Wider Peak District & Local Enterprise Partnership D2N2

The D2N2 Local Enterprise Partnership (LEP) works across Derbyshire and Nottinghamshire to boost the economy and create jobs. As part of its long-term goal of creating 55,000 new jobs in ten years (2013-2023), D2N2 identified the visitor economy as one of its eight key sectors – industry areas with existing strengths and the potential for additional growth [7:3]. D2N2 have strategic plans for growth and funding priorities to grow the rural visitor economy. The visitor accommodation sector is a major contributor to the D2N2 economy and is of vital importance for future tourism growth and employment creation [9].

A strong visitor economy is important to the economic health of the area. Generating an estimated £315m [10] in visitor spend, it provides employment, offers business opportunities and helps sustain local services – but there is room for growth. To grow the value of the sector, visitors need to be encouraged to spend more when they come.

The visitor economy sector employs almost 52,000 in the D2N2 area and there is the potential to increase employment by increasing opportunities and markets. For instance, the growth of cycling as a leisure pursuit can be built on through events such as Eroica and the Monsal Trail development [11].

What are the gaps in our research and data?

- Volume visits to protected areas like national parks are difficult to measure. Further research is needed to investigate the actual levels of visitors to the Peak District National Park and their likely impact on the environment and local communities.

- Tourism jobs market: what job opportunities exist for local people? What types of jobs does tourism provide and what proportion of these are offered to local people. [5]

STEAM, “National Parks England Comparison,” Global Tourism Soloutions, 2016. ↩︎ ↩︎ ↩︎ ↩︎

STEAM, “STEAM Report,” Global Tourism Solutions, 2018. ↩︎ ↩︎ ↩︎ ↩︎

Visit England, “National Parks And Domestic Tourism,” 2016. ↩︎

Natural England, “Monitor Engagement with the Natural Envrironment The National Survey on people and the natural environment,” National Statistics, 2018. ↩︎

Natiral England: https://www.gov.uk/government/collections/people-and-nature-survey-for-england ↩︎ ↩︎

Visit Britain, “Deloitte Tourism,” 2013. [Online]. Available: https://www.visitbritain.org/visitor-economyfacts. ↩︎

Visit England, “The value of tourism in England,” https://www.visitbritain.org/value-tourism-england, 2017. ↩︎ ↩︎ ↩︎ ↩︎

Visit Peak District, “Value of Peak District & Derbyshire tourism industry” https://www.visitpeakdistrict.com/industry/news/2019/9/4/value-of-peak-district-and-derbyshire-tourism-industry-hits-ps2-3-billion-7-4-growth-a2504 ↩︎

D2N2, “D2N2 VISITOR ACCOMMODATION STRATEGY,” Hotel Solutions, 2017. ↩︎

DDDC, “Visitor Economy Plan,” http://www.derbyshiredales.gov.uk/images/documents/V/Visitor_Economy_Plan_2015-, (2015-2019). ↩︎

D2N2, D2N2, “The Visitor Economy,” http://www.d2n2lep.org/key-sectors/visitor-economy, 2019. ↩︎